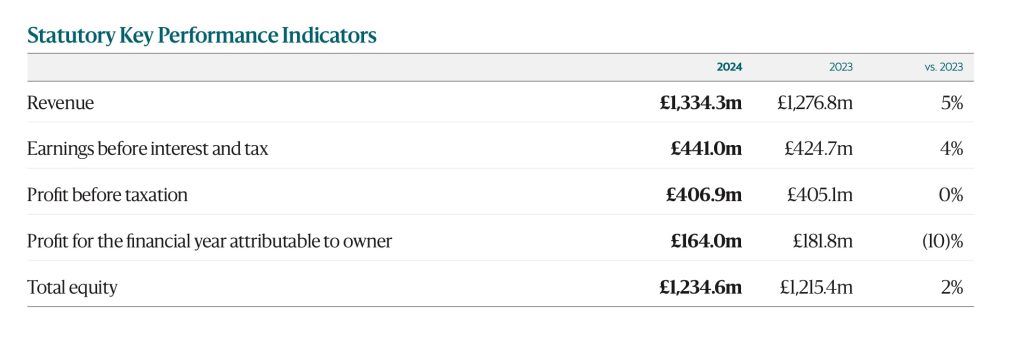

Premium spirits company Edrington recorded a +5% increase in revenues to £1.34 billion (US$1.7 billion) in the 12 months to 31 March. EBITDA climbed +4% to £441 million (US$559 million) with net profits, after exceptional items, decreasing by -10% to £164 million (US$208 million).

The exceptional items include Edrington UK’s exit from the distribution of third-party products, the sale of its investment in Maxxium Cyprus Limited and of its Russian subsidiary to local management.

The performance was a result of the company’s focus on the ultra-premium category, led by core brand The Macallan, and sustained investment in brands, people and supply chain, said the group.

(For commentary on core revenues and core contribution among Edrington’s key performance indicators, see below.)

The Macallan shines ahead of 200th anniversary

The Macallan showed year-on-year growth, driven by innovative partner collaborations such as the Tales of The Macallan Two and Distill Your World Mexico. It was also helped by the successful launch of the global travel retail-exclusive The Macallan Colour Collection, which marked the company’s return to age statement whiskies in the channel.

Commenting on The Macallan’s performance, Edrington Chief Executive Officer Scott McCroskie said: “Our leading brand, The Macallan, had another excellent year. We continue to see impressive work by our teams around the world who bring the brand to life for customers and consumers.

“The brand delivered robust growth in key markets across Asia Pacific and particularly in Greater China. Our EMEIA region, encompassing Europe, the Middle East, India and Africa, performed well, whilst markets in the Americas were most affected by weaker consumer demand.

“The Macallan’s new range for travel retail, and particularly for airports, the Colour Collection, has delivered positive early results. Celebrations to mark The Macallan’s 200-year anniversary have begun with a partnership with Cirque du Soleil, and the bicentenary will see The Macallan release a range of special editions and communication campaigns to highlight its blend of craftsmanship and creativity.”

McCroskie added: “Edrington has navigated a challenging year to deliver financial results that are among the best in the spirits industry. Our strategy of focusing on ultra-premium spirits continues to deliver healthy brands and a strong underlying performance.

“However, we consider that the economic pressures that we saw in the second half of last year will adversely affect demand. While we will continue to invest in our brands, in our operations and in sustainability, the business is planning for the coming year on the basis of lower levels of growth than we have experienced since the end of the pandemic.”

“The results set out in this report are built on a legacy of exceptional performance by generations of dedicated people,” added Edrington Chairman Crawford Gillies. “Each of our brands is steeped in its own heritage and tradition, and this year we are particularly proud to mark 200 years since The Macallan was first distilled. We look forward to seeing the spectacular products and compelling experiences and stories that the brand will share during the coming year.

“It is under Edrington’s stewardship that The Macallan has flourished, attaining its status as the world’s most-valuable single malt Scotch whisky. I consider it the primary example of what Edrington’s carefully developed strategy, talented people and steadfast commitment to both investment and innovation can achieve.”

The Macallan Managing Director Igor Boyadjian added: “The Macallan’s reputation for quality and innovation has continued with the launch of sought-after limited editions and permanent expressions. Our Colour Collection has generated an enthusiastic response from customers and consumers in global travel retail. We have also released The Macallan Horizon, a feat of design and engineering born from our long-term partnership with Bentley Motors.

“The Macallan also embarked on a creative collaboration with Stella and Mary McCartney last year. The third release from the brand’s Harmony Collection, with two expressions – Amber Meadow for the domestic market and Green Meadow as a travel retail exclusive – celebrates the beauty of Scotland and respect and admiration for the natural world.”

Increased brand investment amid premiumisation drive

Edrington invested £262 million (US$332 million) in brand marketing and communication in FY2024, a +16% increase versus the previous year and more than doubling in the last four years.

The repositioning of Highland Park and The Glenrothes brands continued amid a major premiumisation drive. The Famous Grouse performed well in key markets, while The Brugal showed growth following the launch of further ultra-premium rum expressions Maestro Reserva and Colección Visionaria.

The group increased investments in its sherry cask supply chain through the purchase of Vasyma, a cooperage in Jerez Spain, and an investment in American oak supplier Coopers Oak.

Management KPIs

Edrington highlighted two management key performance indicators (KPIs) during the financial results. Core revenues rose +11% to £1.165 billion (US$1.48 billion) and core contribution increased by +16% to £454.8 million (US$576.56 million).

Core revenue represents sales of continuing Edrington branded products on a constant currency basis, while core contribution represents the profits from branded sales and distribution after the deduction of overheads.

Growth across these two KPIs was particularly strong in the first half, which offset significant reduction in consumer spend in the second half of the year.

Gillies commented: “The strong growth generated in the first six months of the year helped the business to manage the impact of a global slowdown in the second half of the year with core revenue and core contribution delivering double-digit growth.

“Our strategic focus on ultra-premium spirits continues to drive our success and fuel a cycle of re-investment that has delivered industry-leading performance over several years.

“Recognising the debt we owe to our predecessors who have nurtured the business with investments that could never be fully realised in their own time, we in turn must invest for the long term. Indeed, in an industry that is more long-term focused than most, our approach and strategy are demonstrably focused on the long term.”

Gillies added: “Following on from the partnership with Grupo Estévez in 2023, we have further deepened our investments in the finest sherry-seasoned oak casks with the acquisition this year of the Vasyma cooperage business based in Jerez, Spain. We also entered a joint venture partnership with Coopers Oak of Ohio, which provides high-quality American oak for casks. The full benefits of these strategic investments will be delivered over decades to come.”